Enterprise value, or EV for short, and equity value are 2 common ways that a business may be valued in a merger or acquisition. Even though both are commonly used in valuing a company, both offer a slightly different view of the company at hand. The EV presents an accurate calculation of the overall current value of the business available to all stakeholders, whereas equity value provides the value of the business available to equity investors.

Equity Value

The equity value of the company, also known as market capitalization, is defined as the total value of the company attributable to equity investors. It can be calculated by multiplying its share price and the number of shares outstanding.

The main difference between equity value and EV is that equity value only takes into account the value of a company attributable to equityholders, meaning that the debt that the company has on its balance sheet is not reflected when calculating it. When performing a discounted cash flow analysis to derive equity value, you should use cost of equity as the discount rate.

Enterprise Value

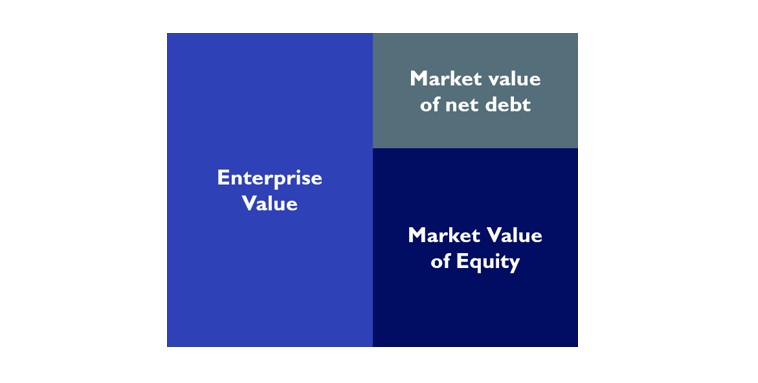

As mentioned above, the enterprise value of the company considers the value of the company’s entire business, not just the portion owned by equity investors, meaning all ownership interests and asset claims from both debt and equity are included. It can also be thought of as the effective cost of buying out a company (before a takeover premium is considered). To calculate a company’s EV, we take the market value of equity as calculated above and add net debt (which is the amount of debt less the cash) to it. When we do this, we consider the value of debt attributable to the company so that both debt and equity holders understand the value of the company. When doing a discounted cash flow analysis to find EV, the discount rate used should be the Weighted Average Cost of Capital (WACC) and the cash flows should be unlevered.

How do we use this information?

As both EV and equity value are useful to investors when deciding to invest in or buy out a company, it is important to understand the underlying meaning behind these terms and what they suggest about the company. With this knowledge, investors can then make more informed decisions to validate the returns on investment they hope to achieve. Remember: the biggest difference is that EV places a value on the entire company while equity value only measures the value attributable to equity investors.